How CredMate works

Empowering Financial Trust Through Innovation

1

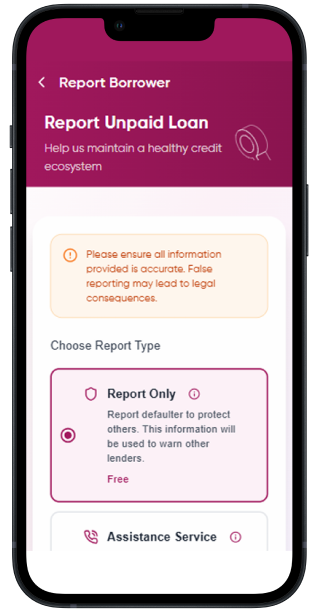

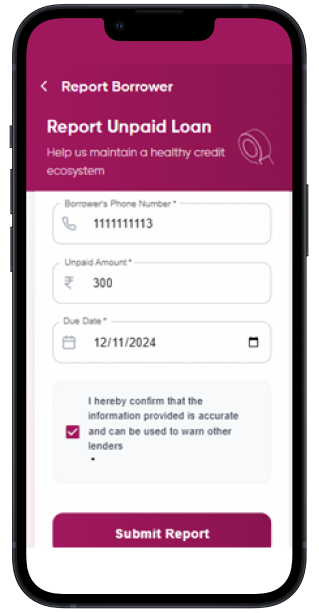

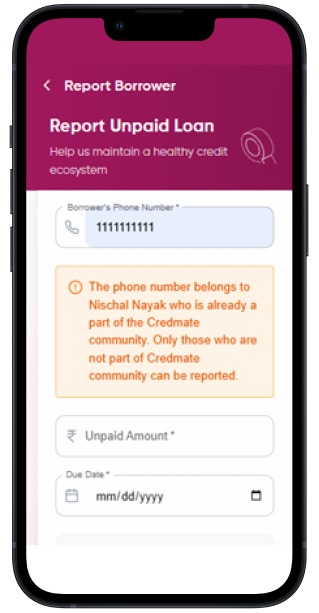

Report Borrower

Submit unpaid loan details securely and help maintain a healthy credit ecosystem. Our advanced verification system ensures accuracy and fairness.

Submit unpaid loan details to help maintain a healthy credit ecosystem.

Previous

Before submission, we verify if the borrower is a CredMate user; if not, we alert lenders of potential risk, but if listed, reporting is restricted due to verified repayment data.

Previous

2

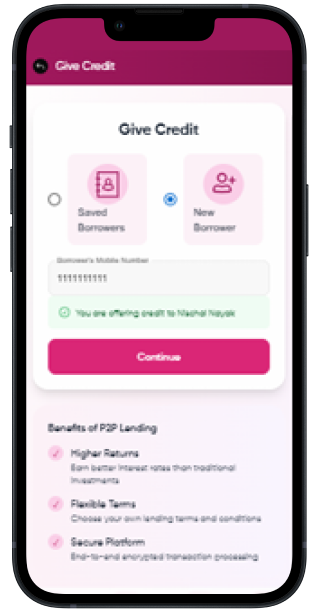

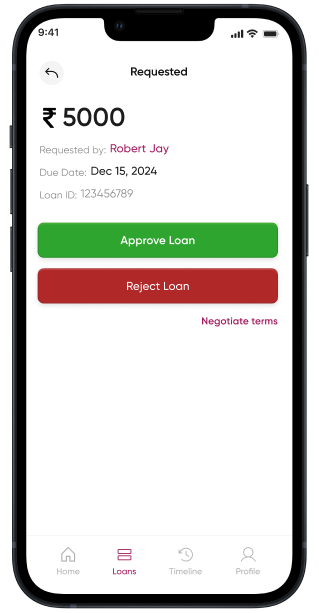

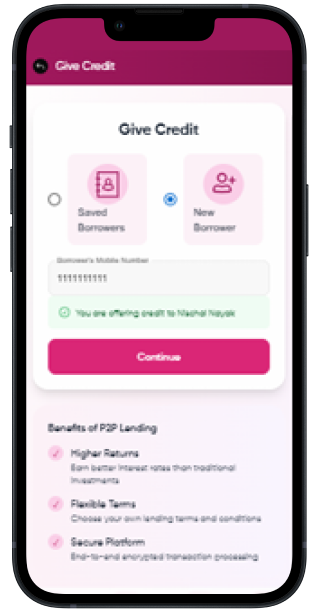

Give Credit

Lenders can directly offer credit to borrowers

Previous

The borrower has the option to accept the offer, decline or negotiate the terms.

Previous

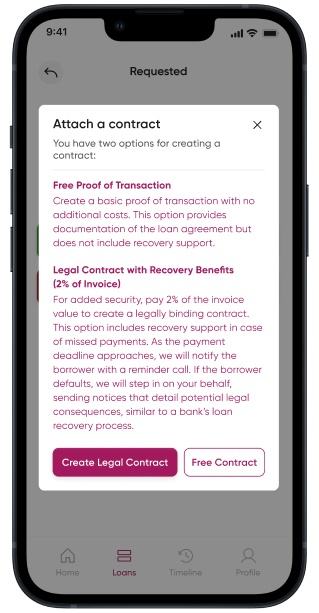

Once both parties agree after negotiation, a free contract or a legal contract is created

Previous

3

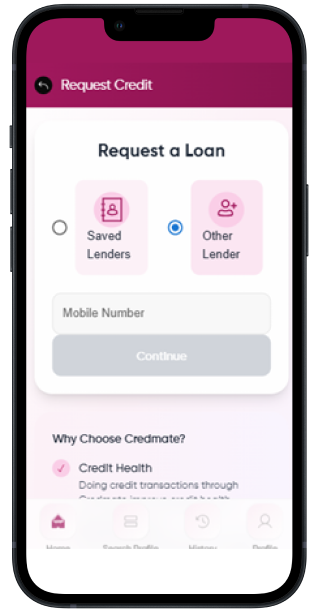

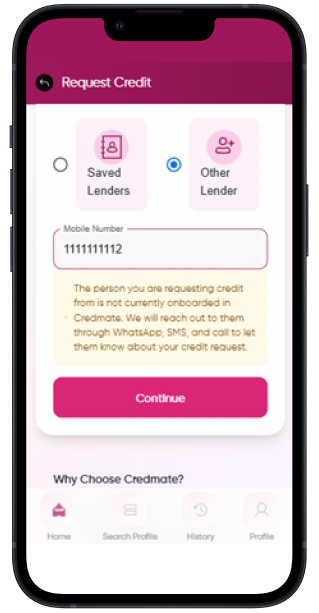

Request Credit

A borrower can request credit from a lender and also from a saved lender they requestfrom freqently

Previous

The borrower can search for the mobile number of all credmate users

Previous

The borrower can also enter a number and request credit from a mobile number not registered on the Credmate platform. We will notify the lender through WhatsApp, SMS, or other means

Previous

All the features mentioned above can be subject to availability only for those

who have subscribed to a plan.

who have subscribed to a plan.

01

Report Borrower

Submit unpaid loan details securely

02

Give Credit

Offer direct credit to borrowers

03

Credit Request

Request credit from trusted lenders